Bonus Depreciation 2024 Percentage Change

Bonus Depreciation 2024 Percentage Change. However, the current rules are set to change. This means businesses will be able to write off 60% of.

For 2023, that percentage is generally. The tax cuts and jobs act (tcja) of 2017.

Bonus Depreciation Changes The Way That Depreciation Works.

31, 2022, and before jan.

7024, The Tax Relief For American Families And Workers Act Of 2024, Which Includes 100% Bonus.

In 2024, the bonus depreciation rate will.

Bonus Depreciation Is A Significant Tax Incentive That Allows Businesses To Immediately Deduct A Substantial Portion Of The Purchase Price Of Eligible Assets In The Year They Are.

Images References :

Source: nevsaqkaylyn.pages.dev

Source: nevsaqkaylyn.pages.dev

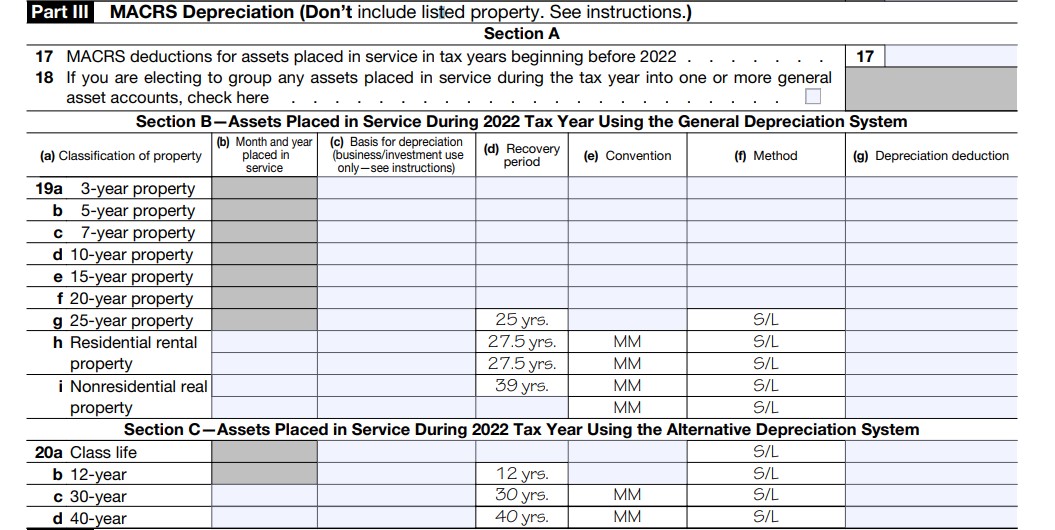

Section 179 And Bonus Depreciation 2024 Lenka Imogene, Under the new law, the bonus depreciation rates are as follows: Unless the law changes, the bonus depreciation percentage will decrease by 20 points each year over the next several years until it phases out entirely for property placed in.

Source: sailsojourn.com

Source: sailsojourn.com

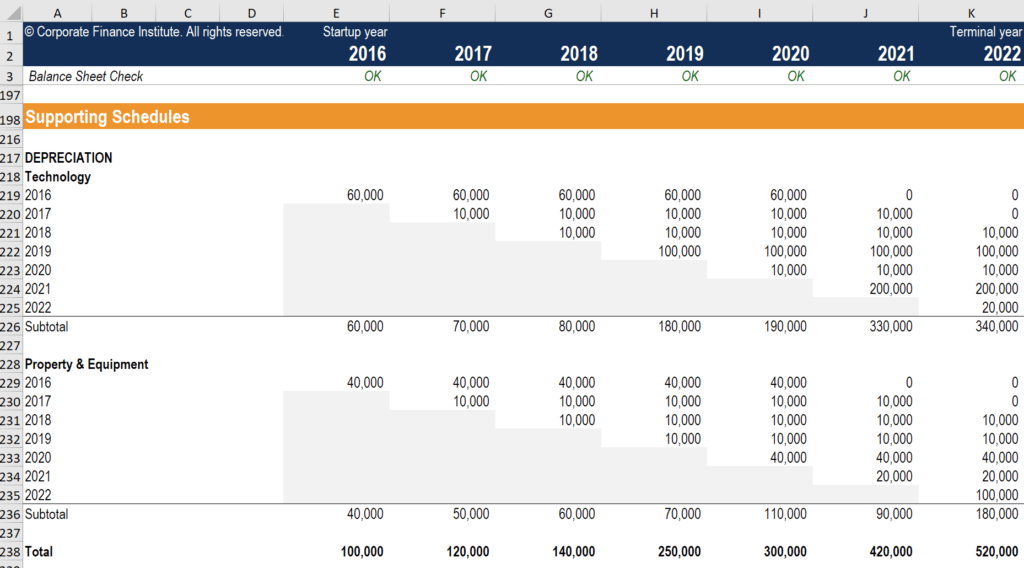

8 ways to calculate depreciation in Excel (2024), Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production of income, the additional first. One of the most significant provisions of the tax cuts and.

Source: nevsaqkaylyn.pages.dev

Source: nevsaqkaylyn.pages.dev

Section 179 And Bonus Depreciation 2024 Lenka Imogene, Bonus depreciation is a significant tax incentive that allows businesses to immediately deduct a substantial portion of the purchase price of eligible assets in the year they are. Bonus depreciation deduction for 2023 and 2024.

Source: sailsojourn.com

Source: sailsojourn.com

8 ways to calculate depreciation in Excel (2024), The impact of tax reforms on bonus depreciation in 2024 is an important consideration for businesses planning on leasing equipment. One of the most significant provisions of the tax cuts and.

Source: drucillwbilly.pages.dev

Source: drucillwbilly.pages.dev

No Bonus Depreciation In 2024 Rhody Cherilyn, Bonus depreciation deduction for 2023 and 2024. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production of income, the additional first.

Source: ademolajardin.blogspot.com

Source: ademolajardin.blogspot.com

Bonus depreciation calculation example AdemolaJardin, For 2023, that percentage is generally. In 2024, the bonus depreciation rate is set to reduce from 80% to 60%.

Source: penniqpaloma.pages.dev

Source: penniqpaloma.pages.dev

Auto Bonus Depreciation 2024 Donni Gaylene, Bonus depreciation comes into play after the section 179 deduction limit is reached. One of the most significant provisions of the tax cuts and.

Source: taxfoundation.org

Source: taxfoundation.org

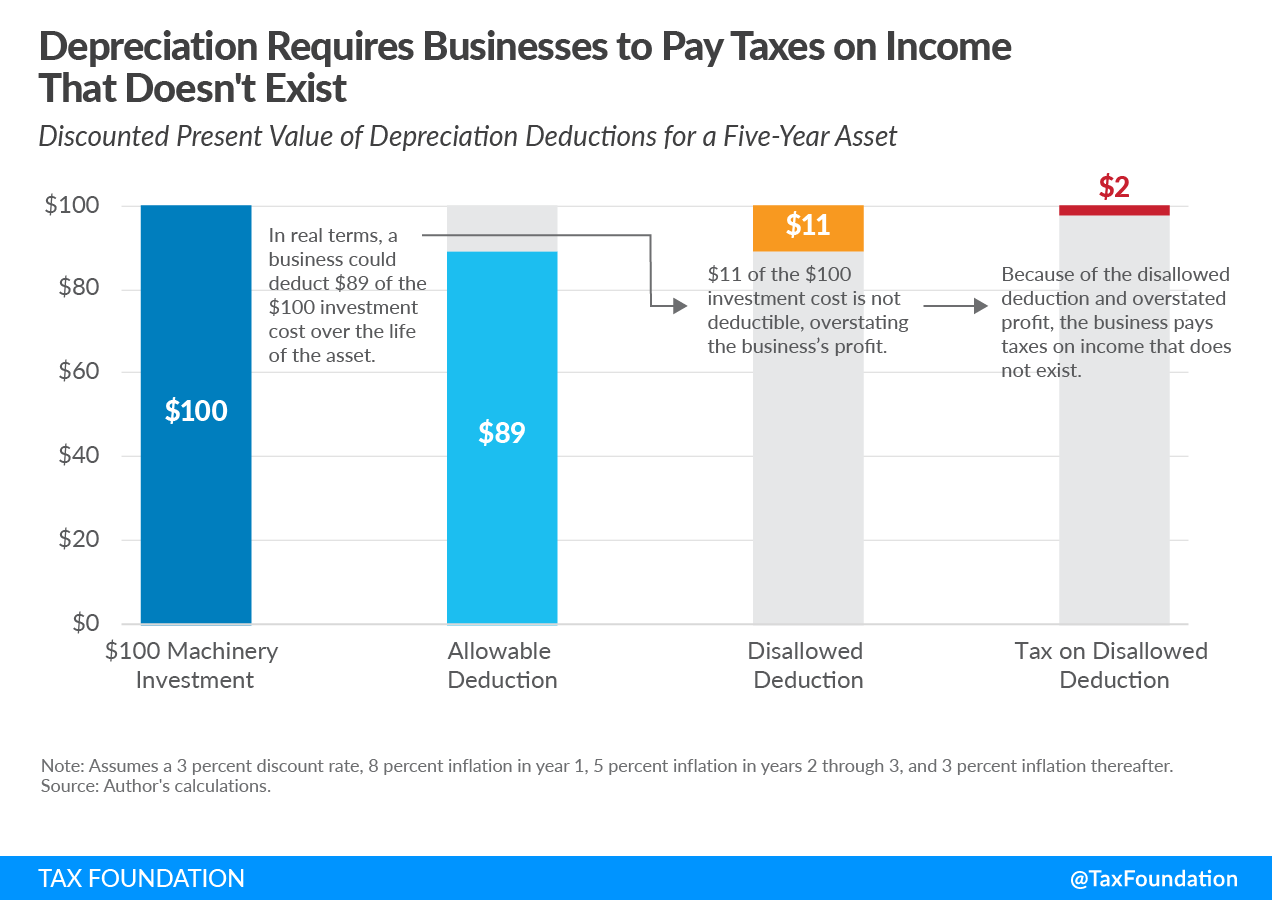

Bonus Depreciation Effects Details & Analysis Tax Foundation, Though the amount a taxpayer is able to deduct in the first year is. One of the most significant provisions of the tax cuts and.

Source: investguiding.com

Source: investguiding.com

Rental Property Depreciation How It Works, How to Calculate & More (2024), Bonus depreciation comes into play after the section 179 deduction limit is reached. Unless the law changes, the bonus depreciation percentage will decrease by 20 points each year over the next several years until it phases out entirely for property placed in.

Source: www.bank2home.com

Source: www.bank2home.com

Bonus Depreciation Calculation Example Ademolajardin, Assets acquired during the bonus period (september 27, 2017, to january 1, 2023) can receive. Cash flows from operating activities:

Though The Amount A Taxpayer Is Able To Deduct In The First Year Is.

Unless the law changes, the bonus depreciation percentage will decrease by 20 points each year over the next several years until it phases out entirely for property placed in.

This Guide Offers A Detailed Look Into The Mechanics And Strategic Application Of Bonus Depreciation In 2024, Particularly Focusing On New Developments And How.

Cash flows from operating activities: